How to Budget and Plan for TV in 2026

The TV market is moving faster than ever. Streaming is scaling, measurement is maturing, and AI is reshaping how campaigns are planned and executed. As advertisers prepare for 2026, the question isn’t whether TV can perform, but how to harness it with precision.

As you plan next year’s budgets, we want to give you a comprehensive reference guide that clarifies micro and macro market trends, inventory dynamics, and emerging opportunities, culminating in a quarter-by-quarter breakdown of the biggest moments on TV. We encourage you to set aside 15 minutes to read this when you can. We promise it will be worth your time. And if nothing else, you can always skip straight to the summary at the end - we won’t tell anyone.

Ad Spending Increases as Optimism Rebounds

Marketers are heading into 2026 with more optimism than they had a year ago. Economic turbulence has (somewhat) cooled, and most brands expect to increase their advertising budgets. The global ad market is forecast to grow 9% driven by a mix of traditional and digital media investments - well, primarily digital. Nine in every ten incremental marketing dollars will go to online-only platforms, according to WARC’s latest global projections. Still, 2026 is shaping up to be a steadier, more predictable environment, and marketers are planning accordingly.

77% of Brands Plan to Increase Their TV Investment in 2026

As overall ad spending grows, TV is poised to absorb a meaningful share of those dollars. That’s because, despite our infatuation doom scrolling Tik-Tok reels or mindlessly consuming short-form AI-generated cat videos, we’re still glued to the largest screen in the house for premium, original content - the television. In 2025, US adults (still) spent an enormous amount of time consuming traditional linear TV. Meanwhile, streaming TV (which includes all forms of OTT streaming and digital pay TV) has rapidly increased and is projected to equal time spent with traditional broadcast TV in 2026.

Altogether, US consumers are expected to spend an average of six hours and 33 minutes a day watching streaming video and traditional TV by 2029. Among those, streaming will represent the largest growth area, increasing to an average of 4:08 - a 7% compound annual growth rate (CAGR) according to Activate Consulting.

This explains why eMarketer is forecasting total TV ad spend to rise to nearly $86 billion in 2026, a 4% increase from last year. Our own data reinforces this trend.

We asked our clients to share if they anticipate any changes to their TV ad budgets in 2026, and an overwhelming majority (77%) said they will be increasing their investment.

TV Advertising Is Expected to Drive Meaningful Value All Year Long

That willingness to invest is backed by something we haven’t seen at this level in years: genuine confidence. Advertisers aren’t just increasing budgets because the market feels steadier, they believe TV is positioned to deliver real results next year. More than eight in ten advertisers said they expect to see strong TV performance in 2026, with the majority describing themselves as optimistic and a sizable share expecting results to outperform 2025.

A big part of that optimism comes from how advertisers expect TV to drive value across their media mix. The fundamentals like reach, attention, and measurable impact remain firmly in TV’s wheelhouse even as viewing habits evolve. Nearly all advertisers say TV will be a primary source of incremental reach next year, which comes as no surprise given the continued fragmentation of digital channels and the rising cost of acquiring new audiences elsewhere. They also see TV delivering reliable performance impact, something that has strengthened as more campaigns combine linear and streaming to deliver measurable outcomes in near real time.

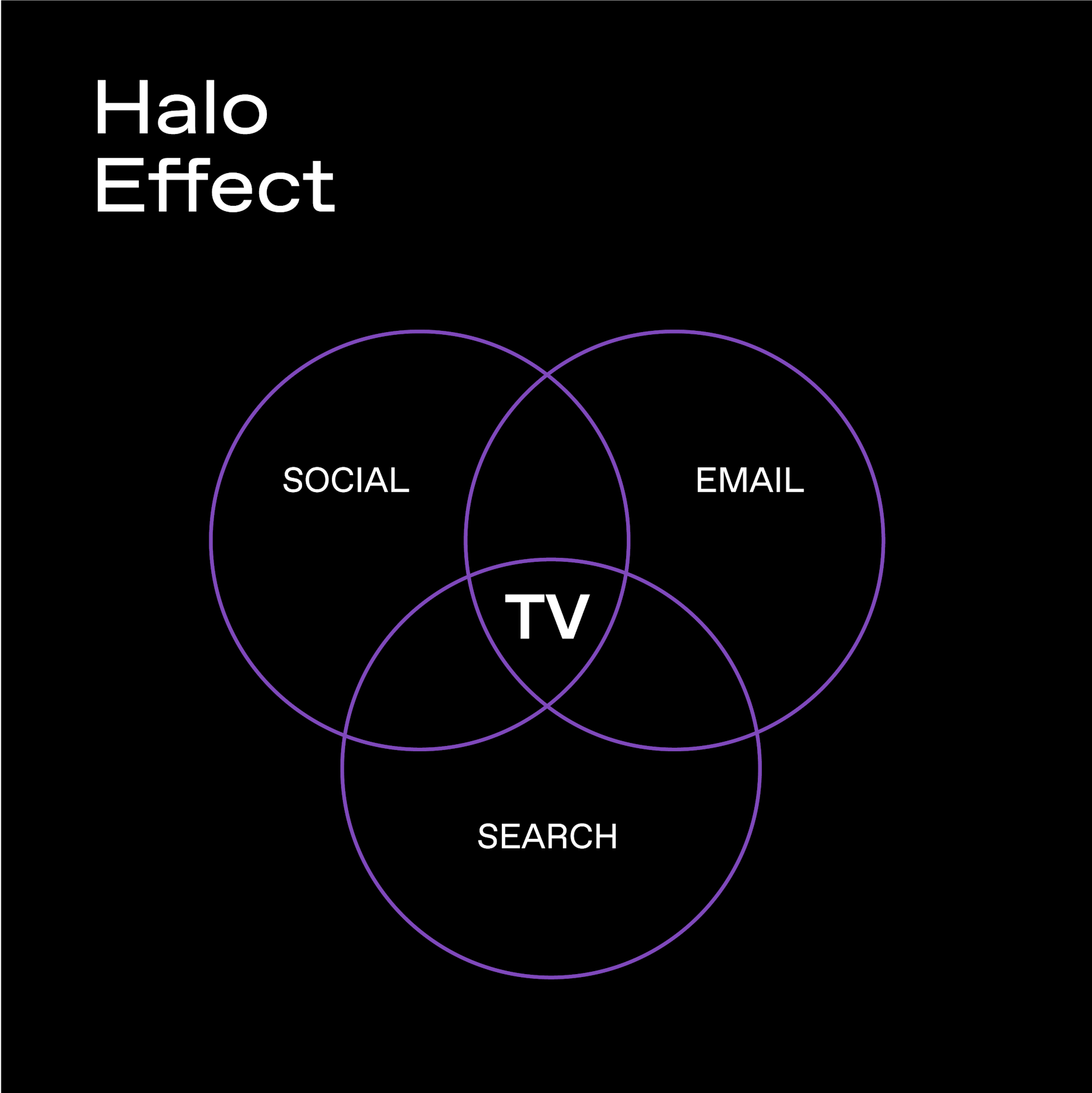

But the story goes beyond the standard KPIs. Many advertisers anticipate TV playing a larger role in amplifying other channels in 2026 thanks to TV’s innate halo effect. That includes boosting paid social and search, and even impacting offline retail sales by creating demand and driving consumers into lower-funnel environments. Others highlight TV’s ability to scale quickly, especially around cultural moments, product launches, and seasonal bursts. And while expectations for “above-forecast ROI” are more tempered, advertisers see TV as a dependable contributor to both brand growth and measurable performance that’s well worth the investment.

Key Takeaway:

For advertisers, the message heading into 2026 is clear: plan early, budget deliberately, and treat TV as a multi-channel strategy to capture evolving viewership behaviors. With overall ad spend rising, and a disproportionate share flowing to digital media and streaming channels, competition for premium, high-value inventory will intensify. The brands that will benefit most are those that lock in budgets early, map out where each piece of TV can deliver unique value, and give themselves room to optimize as the year unfolds. In a market where confidence is high and demand is increasing, waiting could leave you playing catch up to your competitors.

Streaming is Growing, Now with More Ads

It wouldn’t be our annual planning guide if we didn’t talk about the explosive growth in streaming. Yes, I know we say this every year, but this time, the numbers are undeniable. By 2026, more than 80 million U.S. households will have cut the cord, eclipsing the 54 million still holding onto traditional TV. Nielsen shows streaming already sitting shoulder-to-shoulder with broadcast and cable in total viewing time, and its share will only continue to rise as millions of viewers migrate to streaming, especially as broadcast mainstays like live sports move to these platforms. By next year, fewer American households than ever before will have traditional TV by 2026.

What’s different this year is that ad‐avoidance is giving way to ad-acceptance. As subscription fees soar into the $20+ range, many viewers are downgrading to cheaper, ad‑supported plans. Not to be confused with FAST channels, like Roku and Tubi that combine traditional broadcast models with modern technology and offer a mix of new and vintage programming like news, sports, and a dedicated channel for binge-watching episodes of Who’s the Boss? No, the ad-supported subscription model is extending to streaming powerhouse giants like Netflix, Disney, HBO Max, and others.

81% of free-streaming subscribers (and 69% of paid subscribers) say they’ll accept commercials in exchange for free or cheaper viewing packages. And when it comes to the media channels where ads seem as acceptable as an ad can be for being tolerated, TV tops the list. 43% of adults feel TV is an acceptable place for ads.

We’re already seeing the payoff: Netflix now reports that 45% of all US viewing hours on its service are on the ad-supported tier (up from 34% a year ago). Other major services have seen similar jumps: eMarketer notes Disney+ ad-viewing share jumped 16 points year-over-year (HBO Max, Prime Video and others are each up about 10 points). In short, millions of viewers who once shunned ads are now opting in for ads if it helps cut down on their monthly bills.

For advertisers, this has huge implications. It means new inventory that never existed a few years ago is now in reach. On top of that, with CPMs stabilizing as streaming ad inventory increases faster than demand, publishers are eager to negotiate, giving advertisers more opportunities to test into a wider range of streaming networks and engage targeted audiences while testing different formats without stretching their budgets.

Streaming Will Require Both Direct and Programmatic Buying

While streaming will unlock more premium opportunities in 2026, the brands that will benefit most will be intentional about how they buy. Despite streaming gaining a substantial share of programmatic display dollars and programmatic media buying serving as the primary method for accessing streaming media, data from Freewheel's Video Marketplace Report shows most streaming deals are still done through direct transactions, with roughly two-thirds of streaming transactions coming through direct IO.

Inventory like live sports and some specific-high value content can still only be bought this way. And while more of this programming will be opened up thanks to emerging technology like dynamic ad insertion (DAI), the smartest approach is a balanced one: using programmatic for its scale and flexibility, but anchoring your strategy with more direct, transparent supply paths. This ensures you get quality inventory, cleaner data, and protection from unnecessary intermediaries. In a year where competition for TV impressions will intensify, advertisers who streamline their supply routes and plan holistically across both linear and streaming TV will see stronger efficiency and more reliable performance.

About linear…

A More Nuanced Reality for Linear TV

While streaming is driving most of the growth in viewership, linear is far from obsolete. Roughly half of the country still consumes television through traditional pay TV. Every month, the Nielsen Gauge shows an equal split between linear and streaming viewership, with the pendulum swinging back and forth based on seasonal moments such as live sports and cultural TV tentpole events. I’m looking at you 2026 Winter Olympics.

These TV events draw audiences at a scale most streaming platforms simply can’t replicate - not yet at least. Today, when streaming carries marquee programming, the infrastructure isn’t always equipped to handle the surge of viewers. High-profile bandwidth failures during recent live events have reinforced why linear remains the most stable and reliable path for mass reach.

For advertisers, that reliability shows up in the metrics that matter. Linear still generates the vast majority of TV ad impressions thanks to higher ad loads and broader distribution. iSpot reports that linear accounts for roughly 86% of all TV ad impressions, about 17 billion per day, and linear accounted for nearly 90% of the time viewers spent watching ads. Yes, impressions are gradually declining, but not fast enough to warrant a shift away from linear.

Linear is also where many brands see stronger lifts in brand awareness compared with streaming alone. The channel leads for boosting brand favorability (9%) over CTV (2.7%) and improving message association (a 5.6% boost versus CTV’s 0.9%). Second to only out-of-home (OOH), traditional linear TV will continue to play a critical role in reaching high-intent audiences at the moments that matter.

Key Takeaway:

Despite streaming viewership accelerating, linear still delivers the overwhelming majority of TV ad impressions, as evident in our own data. Even as our clients spend more on linear, when looking at the month-over-month client data, we see there’s far less audience overlap between the two channels than many expect. Most viewers reached on linear are not the same ones reached on streaming, which means leaning too heavily into one channel over another creates gaps in reach.

We also see this play out in performance. When linear and streaming run together, campaigns benefit from both broad scale and precise targeting. But when brands rely on streaming alone, we consistently observe a drop in top-funnel volume and a noticeable increase in acquisition costs.

For 2026, advertisers should approach budgets strategically, allocating spend across both linear and streaming to maximize reach and performance. Half of the brands we surveyed plan to include both in their TV mix, reflecting a growing recognition that a balanced, convergent approach delivers the most complete results. Prioritize linear where scale and awareness matter most, complement with streaming for targeting and efficiency, and use both together to build a stronger, more effective TV plan to meet your goals.

Global Events Poised to Fuel TV Advertising Boom

By all accounts, 2025 was a relatively quiet year for TV, unless you count the children's show Bluey quietly becoming the world’s most-streamed show with up to 25 billion minutes streamed. I guess if you have kids, you already know this. “6, 7”. IYKYK. Nevertheless, 2026 is expected to be a boom year for TV thanks to major events like the Winter Olympics, mid-term elections, and the FIFA World Cup.

Following the monumental success of the 2024 Summer Olympics, NBC hopes to carry that momentum to Italy for this year’s winter games. It’s already shaping up as a high-potential, high-value target for TV advertising investment. According to MRI, nearly 1/4 of adults or an estimated 56 million people are actively planning to watch the games over the 3-week period across linear and streaming this February. If your objective is broad awareness or category leadership, allocating a meaningful but measured portion of your TV budget to Olympic windows can deliver an efficient share of voice. If your aim is direct response, you can explore targeted streaming overlays, experiment with geo-tests around specific events, or test one-off segment sponsorships at the broadcast-level.

Equally commanding is the 2026 FIFA World Cup kicking-off (see what I did there?) this summer and airing across FOX properties. The scale of recent World Cups demonstrates that even conservative TV ad buys can yield strong reach and social amplification. Advertisers can run a focused experiment: buy high-impact dayparts for a select set of matches that match your demo, pair those buys with streaming targeting for incremental reach, and insist on pre-defined measurement (reach lift, site traffic, and social engagement) so you can make a clear decision for expanded investment.

Perhaps the biggest competition in 2026 won’t be played on the field, but in voting booths across America. With midterm elections taking place, political ad spending is projected to reach new records. Market forecaster AdImpact projects $10.8 billion will be spent on political ads for the 2026 cycle, up 20% from 2022. The ramp-up in political ad spend will likely tighten supply and push CPMs higher on news networks and in highly competitive markets from early 2026 through the Election Day.

While these events are set to anchor the year on TV in 2026, annual tentpole programming still moves the needle. The Super Bowl remains television’s single biggest reach event with last year’s game setting a viewership record with over 127 million viewers. This year’s game, airing across NBCUniversal (NBC, Peacock, and Telemundo) is expected to top that number. It’s no wonder ad inventory sold out before we even knew where Aaron Rogers would end up playing this time around (sorry, Pittsburgh). Despite prices ranging between $7 million to $8 million per 30-second spot, Tatari has already helped 4 of our clients secure spots across both the linear and streaming broadcast - work that requires up-front negotiation and publisher relationships you can’t replicate in an open DSP.

A broader roster of live sporting events keeps appointment viewing consistent throughout the year - and ad-supported TV viewership booming. From the NHL and NCAA to the NBA and WNBA - which has seen explosive growth - even “non-legacy” leagues can deliver sharp engagement spikes. Then there’s the MLB, where the most recent World Series averaged almost 15 million viewers and hit it out of the park for advertisers.

While major sporting events and top-tier scripted programming have long been staples, a deeper look into advertiser sentiment reveals that time-sensitive and seasonal programming are expected to be the most critical for achieving a true "breakthrough" in 2026. Among the Tatari clients surveyed, Holiday Programming led the list, with 65% of advertisers believing it will be important for cutting through the noise, with Sports and News (62%) a close second. More than half also think Top Entertainment Programs (59%) and Syndicated TV (56%) will be impactful to run on. Reality TV is the only category where the majority of respondents answered 'No' (56%), confirming it is perceived as the least important programming type for breaking through on TV compared to high-stakes, time-bound events.

The TV Programming that Will Move the Dial in 2026

Holiday Programming | 65% |

Major Sporting Events | 62% |

News | 62% |

Top Entertainment | 59% |

Syndicated TV | 56% |

Reality TV | 44% |

*Tatari client data, 12/25

Key Takeaway:

In a year with more tentpole programming than last year, advertisers need a balanced TV strategy that mirrors viewing behavior; anchoring reach through linear, layering in direct streaming buys for precision and premium placements, and using programmatic to flex, scale, and fill gaps as viewership surges around major events. Doing so will require planning ahead, or at least carving out budgets for last-minute opportunities that may arise, as well as a diversified mix across platforms, while treating TV partners as strategic allies so you can show up in the moments that matter while still hitting performance, reach, and budget goals.

Advertisers Press Play on Interactive Ads

As streaming viewership grows and the competition for attention rises, more advertisers will start experimenting with interactive ads to capture engagement. Unlike traditional mid-rolls, interactive units create engagement because viewers choose to engage, whether that’s pausing a show, exploring a product carousel, or snapping a QR code for more information. This level of interactivity offers advertisers a new path to TV performance without requiring a Super Bowl-level budget or placement.

Pause ads in particular are emerging as the breakout format. Industry analysts highlight pause ads as “high-value, low-friction” units that capitalize on the rare moment when a viewer is fully invested and not competing with other content. eMarketer notes that pause ads deliver unusually strong attention and recall because they appear in an uncluttered viewer-initiated context — a dynamic that aligns with the 51% action-rate and 30% lift in awareness shown in own interactive benchmarks for clients that have been testing these formats.

Beyond pause ads, a variety of interactive formats like shoppable ads, action ads, overlays, and title takeovers will continue to expand as platforms standardize formats and push deeper into retail integration. Any chance not to get off my couch is a win in my book.

Still, interactive campaigns require more setup than standard streaming spots. Publisher workflows are inconsistent, creative requirements vary, and pixel management is still manual. Programmatic pipes aren’t fully ready either — the formats exist in theory, but activation is limited, and major publishers require high minimums. That’s why most interactive units still flow through direct IOs today. But this is also why 2026 is the right year to start testing: automation is improving, publishers are standardizing processes, and Tatari is actively working on faster setup, shared workflows, and same-day measurement notifications to reduce complexity.

Key Takeaway:

Interactive ads shouldn’t replace your core TV strategy, they should complement it. The smartest 2026 plans will pair linear reach and streaming tentpoles with a structured interactive test-and-learn plan. Start with pause ads for scalable, low-clutter engagement, layer in one or two shoppable or overlay formats, and buy them directly through publishers to access preferred inventory, stronger measurement, and more controlled execution. Then use programmatic to broaden reach and pressure-test performance at lower CPMs. Thanks to evolving technology and AI, interactive ads will be more accessible to test in 2026.

AI Is Tablestakes but Demands Intelligence

Advertisers are embracing AI as a critical tool across creative, planning, and buying - not necessarily as a replacement for human expertise, but as a way to scale it. The most visible shift has been in creative. With AI tools getting better by the day, brands that used to have to spend millions of dollars on filming, editing and producing ads now have the ability to generate video at the click of a button, effectively letting anyone feel like a modern-day Spielberg. A week after airing its fully AI-created ad during the 2025 NBA Finals (an ad we helped facilitate with its airing), prediction market platform Kalshi generated enormous buzz and engagement for their first-ever TV ad. Sure, it was a success, but that doesn't mean everyone can nail it. When Coca-Cola released a fully AI-generated Christmas spot this fall, the response was flatter than an open can left out in the sun. Critics called it “soulless” and “AI slop,” a far cry from the warmth and nostalgia the brand’s ads historically evoked. In fact, most consumers are turned off by the idea of AI being used in ads.

That backlash underscores a key truth about AI heading into 2026: AI can accelerate production and cut costs, but it doesn’t replace the human sensibility needed to create truly memorable, emotionally resonant ads. Even among advertisers embracing AI, few are ready to hand over full creative control. According to our clients, 86% say they won’t use AI to create 100% of their TV ads, and only 2% are ready to try. Instead, most see AI as a support tool that will help automate tasks, speed production, evaluate creative concepts — not exactly the Don Draper replacement some hoped for.

Where AI’s value becomes more concrete is in media planning and buying. The promise isn’t about swapping out media buyers for algorithms, it’s about scaling human expertise. AI and machine learning can analyze years of historical performance, the strategic playbooks of seasoned media buyers, and embed that knowledge into tools accessible to teams at any level. Real efficiency comes from amplifying people, not removing them.

AI-led planning engines can take a campaign goal, and evaluate thousands of inventory combinations in seconds, pressure-testing budget allocations, and surfacing the most efficient plan for achieving the goal before a human ever touches a spreadsheet. This helps set the stage for the future of media buying: a world where impressions are intelligently matched to the brands most likely to benefit, using behavioral, contextual, and historical performance data at a scale no simple DSP or human team could replicate. And in real-world use, brands have already seen bottom-line impact: one of our clients, a premium DTC advertiser, reduced customer acquisition cost by nearly half when routing planning decisions through our media planning engine.

Key Takeaway:

The most successful applications of AI will be used to accelerate the parts of TV that benefit from speed, pattern recognition, and automation while letting humans (and your Tatari team) do what they do best: set direction, uphold brand quality, and make the judgment calls that algorithms can’t. The brands that strike this balance will move faster, operate smarter, and unlock a level of scale and efficiency that simply wasn’t possible before. And by 2027, who knows what will be possible…

TV Measurement Gets More Transparent in 2026

Measurement has long been TV’s biggest challenge, and 2026 will be no exception. Linear and streaming audiences still span multiple platforms and devices, making unified measurement difficult. But the industry is evolving. Advertisers are increasingly prioritizing outcome-driven strategies, leaning on sophisticated attribution models instead of legacy reach and rating metrics. The change has been so swift that Nielsen retired its decades-long panel-based measurement last spring in favor of data-based currencies. They really had no choice, as marketers were already finding more effective alternatives.

Marketers must stay attuned to evolving measurement methodologies, as 2026 may be the first year when cross-media measurement could scale in a meaningful way for the broader TV market. However, the measurement ecosystem remains in flux; multiple tools, measurement currencies, and vendor approaches coexist, and with tightening privacy and data-restrictions on the horizon, the need for reliable and trustworthy performance measurement is only becoming more urgent.

As the landscape shifts, the real challenge for marketers isn’t a lack of measurement tools, it’s stitching them together into something coherent. No single model tells the full story of TV’s impact, and relying on one approach creates blind spots.

A handful of measurement models will become more prevalent as we head into the new year. Geo-based incrementality testing, marketing mix modeling (MMM), omni-channel sales lift analysis, and halo-effect measurement are all becoming accessible to more advertisers, providing multiple data points to assess true incremental performance.

Geo lift tests, for example, use structured experiments to isolate TV’s impact at a local level, giving planners real evidence of effectiveness. MMM allows brands to understand the broad interplay of channels, while omni-channel sales lift and halo effect measurement quantify how TV drives results across eCommerce, retail, and other media touchpoints. And as privacy laws tighten, the models that perform best will be those supported by secure, privacy-first data infrastructure, a major reason we’ve invested in a data clean room (DCR) to ensure match rates stay strong and measurement remains reliable even as identifiers disappear.

Together, these approaches offer a level of measurement fidelity that rivals, and in some cases exceeds, digital channels that offer less transparent outcomes. It’s the core reason we have built a strong measurement ecosystem of partners to give TV advertisers a clear, accurate view of their performance.

Key Takeaway:

With more TV measurement tools available than ever, 2026 requires planners to assemble a coherent, multi-model framework rather than betting on one method alone. The brands that succeed will be the ones that triangulate performance and use measurement as a planning engine rather than a post-campaign report.

Quarter-by-Quarter Recommendations

Q1: Major TV tentpoles fuel streaming and linear viewing

Q1 delivers some of the most compressed inventory of the year. “Q5” fades quickly, CPMs stabilize to normal, and major cultural and sports moments crowd the calendar. This quarter rewards advertisers who get in early, stay flexible, and plan around spikes tied to February’s big tentpole events and the start of March Madness.

Q1 Key TV events and anticipated programming to consider:

NHL Winter Classic - Jan 2 on TNT/TBS

Critics Choice Awards — Jan 4 on E!/USA/ Peacock

Golden Globes — Jan 11 on CBS/Paramount+

Star Search (new series) Jan 13 on Netflix

Fear Factor (new series) Jan 14 on Fox

TNA Thursday Night Impact - (new network) Jan 15 on AMC

A Knight of the Seven Kingdoms - (new series_ Jan 18 on HBO

College Football Championship Game — Jan 19 on ABC/ESPN

American Idol (season 24) - Jan 26 on ABC

Grammy Awards — Feb 1 on CBS/Paramount+

Sunday Night Basketball (new live sports series) Feb 1 on NBC

Winter Olympics — Feb 6–22 on NBC/Peacock

Super Bowl — Feb 8 on NBC/Peacock

NBA All-Star Game - Feb 15 on NBC

NCIS (season 23) Feb 24 on CBS

Scrubs (series reboot) Feb 25 on ABC

Survivor (season 50) - Feb 25 on CBS

Major League Soccer - Feb TBD on Apple TV

SAG Awards - March 1 on Netflix

The Academy Awards — Mar 15 on ABC/Hulu

March Madness — Mar 17–Apr 6 on CBS/TNT/TBS/TruTV

MLB Marquee Opening Night (NY Yankees vs. SF Giants) — Mar 25 on Netflix

MLB Opening Day Week - March 26 on Fox/TBS/MLB Network/Regional

Q2: Spring classics return as World Cup fever fills the air

Come Q2, the best discount windows come right before summer tightening kicks in (pun, intended). The early quarter offers cost-efficient scale, but advertisers must navigate a dense sports calendar and rising pressure in mid-May and June. This is the quarter to efficiently acquire new audiences before the back half accelerates.

Q2 Key TV events and anticipated programming to consider:

The Masters — Apr 9–12 on CBS/ESPN/Prime

WrestleMania — Apr 18–19 on ESPN+

Kentucky Derby — May 2 on NBC/Peacock

Country Music Awards - May 17 on Prime

American Music Awards - May TBD on CBS/Paramount+

U.S. Open (Golf) — Jun 18–21 on NBC/Peacock/USA

Stanley Cup Finals — June on ABC/ESPN

NBA Finals — June on ABC/ESPN

Tony Awards - June 7 on CBS

FIFA World Cup — Jun 11–Jul 19 on Fox/FS1

BET Awards - June 14 on BET/MTV/CMT

Q3: From World Cup glory to binge-worthy summer viewing

Q3 starts with some of the most open inventory of the entire year, especially around July 4, but that openness evaporates quickly. Back-to-school, fall premieres, and sports season kickoffs create a fast-moving marketplace that rewards early commitments. Don’t look now, but Black Friday should already be on your mind.

Q3 Key TV events and anticipated programming to consider:

250th Anniversary of the United States — July 4 on Disney+/Hulu/ABC

Amazon Prime Day — Mid-July

MLB All-Star Weekend — Jul 13–14 on Netflix/Fox

ESPY Awards — Jul 15 on ABC

U.S. Open (Tennis) — Aug 31–Sep 13 on ESPN/ABC

VMAs — Sep 6 on CBS/MTV/Paramount+

NFL Season Kick-Off — Sep 10 on NBC/Peacock

NFL Season begins - Sep 13 on CBS/Fox/NBC/ESPN/Prime

Primetime Emmys — Sep 14 on NBC/Peacock

Q4: From ballots and box scores to the Black Friday buying boom: elections meet prime sports and the holiday rush

Q4 is the most compressed quarter of the year. Holiday retail, elections, major sports, and open enrollment all collide, creating supply shortages and elevated CPMs. The advertisers who win are the ones who plan early, front-load spend, and know exactly which weeks to avoid.

Q4 Key TV events and anticipated programming to consider:

MLB Postseason — October on Fox/FS1/TBS

NBA Season Begins — October on NBC/Peacock/ESPN/ABC/Prime

NHL Season Begins — October on ESPN/ABC/TNT

NCAA Basketball Season Begins — November on ESPN/ABC/CBS/FS1

Midterm Elections — Nov 3 on all major news networks

NFL Thanksgiving Games — Nov 26 on CBS/FOX/NBC

NFL Christmas Day Game(s) - Dec 25 on Netflix

Countdown to Christmas — December on Hallmark Channel

College Football Playoffs (early CFP games + bowls) — December on ESPN/ABC

Notable TV Rights Shifts Coming in 2026

As you’ve seen, 2026 brings a packed calendar of new and returning tentpole programming across every quarter. But it also brings a shifting landscape for where some of these cultural moments will actually air. Longstanding “go-to” networks for major sports and award shows are changing as rights deals evolve and platforms compete aggressively for premium live events. For advertisers, this means that even familiar programming won’t always live in familiar places.

As you build your 2026 media plan, keep an eye on these rights transitions as they can meaningfully change where audiences concentrate and where your dollars go the farthest. Staying flexible, informed, and willing to rebalance your mix as these shifts unfold will be essential to capturing the full value of next year’s tentpole moments.

Property/Event | Previous Rights Owner(s) | Changes in 2026 |

MLB | ESPN, Fox, TBS, AppleTV+ | NBC: Sunday Night Baseball & Wild Card Series Netflix: Opening Night & Home Run Derby * ESPN & AppleTV still keeping their packages |

UFC | ESPN/ESPN+ | Paramount+ Coupled with a few simulcasts on CBS |

F1 | ESPN/ESPN+ | Apple TV |

Pac12 Conference | ESPN, Fox, Pac-12 Network, CW | Adding games to USA |

American Music Awards | ABC | CBS & Paramount+ |

Grammy Awards | CBS | ABC & Hulu/Disney+ (2027) |

We hope this gives you a strong foundation to build an even stronger TV advertising strategy in 2026. If you’re ready to explore how to make TV part of your advertising strategy in 2026, let’s talk!

2026 TV Planning at a Glance

Ad Spending Increases as Optimism Rebounds

Marketers are entering 2026 with renewed confidence and larger budgets as economic conditions stabilize and digital spending continues to surge.

77% of Brands Plan to Increase Their TV Investment in 2026

TV remains a foundational channel as consumers spend massive time across linear and streaming, pushing advertisers to increase investment.

TV Advertising Is Expected to Drive Meaningful Value

Advertisers expect TV to deliver strong incremental reach, reliable performance, and a growing halo effect across other channels in 2026.

Streaming is Growing, Now with More Ads

Streaming viewership is soaring as consumers shift to cheaper ad-supported tiers, opening up new premium inventory for advertisers.

Streaming Will Require Both Direct and Programmatic Buying

Winning in streaming requires a balanced mix of direct and programmatic buying to access premium inventory, ensure transparency, and maximize performance.

A More Nuanced Reality for Linear TV

Linear still delivers the majority of TV ad impressions and the most reliable mass reach, making it indispensable alongside streaming.

Global Events Poised to Fuel TV Advertising Boom

Major tentpole events - 2026 Winter Olympics, FIFA World Cup, elections, and more, will make 2026 one of the biggest years for TV reach and competition.

Advertisers Press Play on Interactive Ads

Interactive ad formats like pause and shoppable ads are emerging as high-engagement opportunities that complement core linear and streaming buys.

AI Is Tablestakes but Demands Intelligence

AI will supercharge creative and media planning, but success hinges on pairing automation with human judgment and brand sensibility.

TV Measurement Gets More Transparent in 2026

Measurement is improving through multi-model approaches that give advertisers clearer, more accurate insight into TV’s true impact.

Dana Delle

I'm a strategist at Tatari and love watching TV after my 3 kids go to bed.

Related

TV's Powerful Halo Effect: What It Is, How Tatari Measures It, and How You Can Harness It

Think Instagram is driving all your sales? Think again. Tatari data shows that TV ads quietly supercharge every other channel—boosting conversions on social, email, and beyond by over 50%. See how we help brands measure TV's full halo effect.

Read more

Why Streaming + Linear Work Better Together

When one advertiser shifted from a dual-channel TV strategy to streaming-only, performance quickly declined. See what happened when they turned linear back on.

Read more

How Brands are Embracing a New Playbook for TV Advertising Success

Discover how marketers are redefining TV as both a performance and brand channel, balancing linear and streaming, measuring halo effects, and making bold, data-driven bets to maximize impact.

Read more